We offer a demonstration of an expert system of financial investment advice. The 'investment' is a small base of 17 facts and 13 rules. It offers investment of money solutions differences taking into account interest rates, inflation, accepted risk ...etc.

This demonstration is just one example of integration of an expert system in a Web application, do not too take the result seriously that it gives, and do not take into account the amounts that she advises.

You can change the rates, amounts, choose the options accepted risk, and availability desired to observe the investment Council that has three data: sum savings, shares and bonds.

In this example, we use AJAX technology to query a web service in which we integrate an expert system to answer and provide financial investment advice. We want just to demonstrate the integration of our ielib.dll component in a web application in ASP.Net.

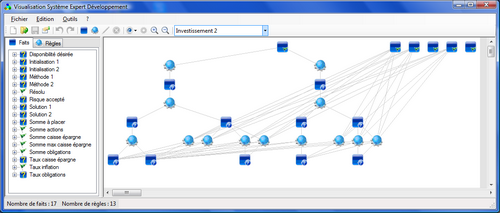

With our software VESD that we designed this knowledge base that we call the 'investment '.

The following source code shows the integration of artificial intelligence in the web service, using the objects InferenceEngine and KnowledgeBase.

[WebMethod]

public InvestResult DemoInvest(int iOpRisk, int iOpAvailability, float fRateBond,

float fRateInflation, float fRateSaving, double dMaxSavings,

double dSumPlace)

{

InvestResult result = new InvestResult();

InferenceEngine ie = new InferenceEngine();

HttpContext context = HttpContext.Current;

if (context != null)

{

HttpServerUtility myserver = context.Server;

ie.CurrentBase.LoadFrom(myserver.MapPath(

ConfigurationManager.AppSettings["InvestBase"]));

}

result.bResolu = false;

result.SumActions = result.SumBond = result.SumSavings = 0.0;

if (!ie.CurrentBase.IsEmpty)

{

KnowledgeBase kb = ie.CurrentBase;

SetFactValue(kb.GetFactById(13), dSumPlace); // Sum to place

SetFactSymbolValue(kb.GetFactById(1), iOpAvailability); // Availability

SetFactValue(kb.GetFactById(15), fRateSaving); // Rate Savings

SetFactSymbolValue(kb.GetFactById(7), iOpRisk); // Risk

SetFactValue(kb.GetFactById(17), fRateBond); // Rate bond

SetFactValue(kb.GetFactById(14), dMaxSavings); // Sum max savings

SetFactValue(kb.GetFactById(16), fRateInflation); // Rate inflation

ChainingResult res = ie.Run();

if (res.Result == ChainingResult.ExecuteResult.Conclusion)

{

Fact f;

for (int i = 0; i < res.Count; i++)

{

f = res[i];

switch (f.Id)

{

case 6: // Resolve

result.bResolu = (bool)f.Value;

break;

case 8: // sum actions

result.SumActions = (double)f.Value;

break;

case 9: // sum savings

result.SumSavings = (double)f.Value;

break;

case 10: // sum bond

result.SumBond = (double)f.Value;

break;

default: break;

}

}

}

}

return result;

}

#region Private section

private void SetFactValue(Fact f, object oVal)

{

if (f != null) f.SetValue(oVal);

}

private void SetFactSymbolValue(Fact f, int iOpIndex)

{

if (f != null)

f.SetValue((string)f.SymbolsList[iOpIndex]);

}

#endregion